Seven major banks and Nationwide Building Society had challenged High Court and Court of Appeal decisions that the charges come under 'unfair contract' rules and are therefore subject to regulation by the Office of Fair Trading.

Today's shock ruling will come as a severe blow to the hopes of millions of bank customers who had hoped to claim back billions in charges.

Campaigners had claimed that the cost to a bank of a customer going overdrawn was less than £2.50 - while banks were charging up to £35 if they went over their agreed overdraft limit.So aside from lending out squillions more than they had in assets, then being bailed out by your money when they failed the banks now see you as a regular cashpoint to be milked for £35 quid or so whenever you slip a penny into the red.

I have had my own experiences of this, firstly with the utter scum at Barclays who after fucking up my account, they even admitted the error was theirs in a letter (as well as contradicting themselves many times) then decided to charge me several times for the privilege of their mistakes. It took me the best part of two years to get back charges/fees they had imposed and put the account in the position that it was before they caused the original error.

To this day after over two years of utterly shit service, not one person at Barclays has ever used the word sorry.

After leaving them for ShatWest, when on one single occasion I made an honest mistake and slipped into the red I had the great fun of dealing with a bank who's systems were almost as inept and crap as Barclays. Still at least I managed to get one charge written off and closed my account before the others could be charged to my account(they were due at the end of the month). In total they wanted to charge me £108 quid.

Then I contacted and complained to the banking ombudsman, something I advise every one to do with a banking charge. Contact the bank when you are charged or they offer bad service, if they refuse to put matters right ask for the details for the ombudsman. They legally have to give you the contact information.

Also when a case go's to them it costs the bank money (£500) so they will often roll over and pay up rather than a complaint going through.

It is also worth noting that many banks now run a policy of complaint scoring and should a branch get say one complaint over the limit and they can lose bonus payouts at branch, so it is worth complaining. I found out about that one in my dealings with Barclays, I was living in that branch so much I was invited out on the staff pissup's.

Of course there is nothing to stop people closing accounts and transferring to another bank their hard earned cash, just explain to the bank that they either get the money owed or off they go.

Ombudsman service is here:http://www.financial-ombudsman.org.uk/default.htm

Update: There may well be that the reason the good overtaxed, put upon people of this land lost this case is the curse of McCyclops striking again. It is well known that who or what ever the mono eye'd PM wishes luck to is utterly fucked, and so when Gordoom put his snotty fingers into the subject of banking charges...

The long-running court battle over bank charges could reach an early conclusion after the prime minister, Gordon Brown, told bank chiefs today to negotiate a solution and resolve the dispute "without further delay".

More than 1m reclaim requests over excessive bank fees and charges have been on hold since July 2007, following the start of a test case brought by the Office of Fair Trading against seven banks and one building society. The case has gone through the high court and the court of appeal and is currently in front of the newly created supreme court.

But in his first intervention in the case, Gordon Brown said : "I believe that a negotiated solution could be in everyone's best interests, and so we have called on the banks and the regulators to explore a quicker way to resolve this without further delay."Ahhhh! That explains it all.

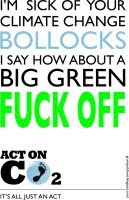

Close to 1 million people have been fucked today, fucked by the banks who they had to fund and fucked again when after appealing about charges have been told to fuck the fuck off.

.

0 people have spoken:

Post a Comment